How To Fill Out A Check

Filling out a check for the first time or after a long time? You could be wondering where to sign and how to write a check with cents. Even if you don’t write many checks, it’s still a useful ability to have. Let us help you out with a brief how-to.

Writing a check is very simple, it just needs little attention and this article will teach you how. Step through each step one at a time, or just use the example as a model for the checks you need to create.

You can do the procedures in whatever order you like as long as the end output doesn’t lack any essential information. In this example, you’ll move from the top to the bottom of a check, which should help you avoid missing any steps.

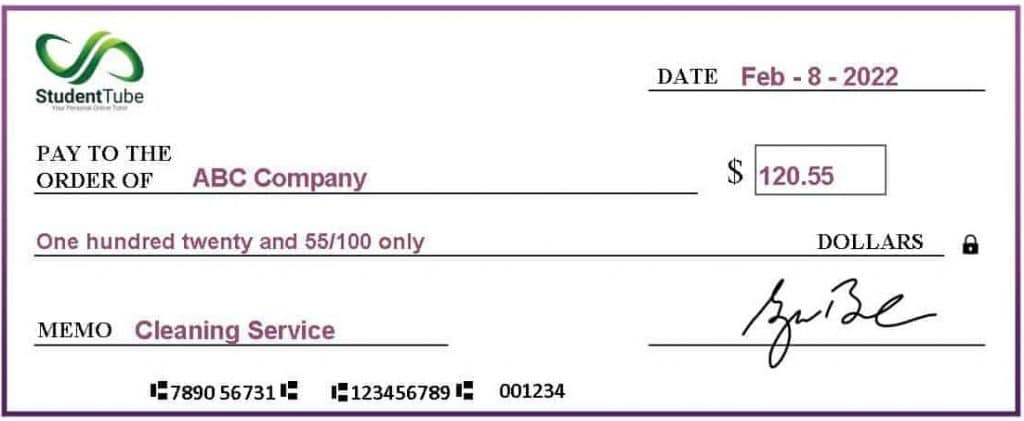

The following are the steps you must take to correctly fill out a check:

Step 1 – In the top right corner, write the date.

Step 2 – Enter the recipient’s name next to “Pay to.”

Step 3 – Next to the “$” sign, write the amount to be paid in numbers.

Step 4 – Write the amount of the payment in words (spell it out) on the long line.

Step 5– Optional: Add a remark in the bottom left corner where it says “memo”.

Step 6 – Sign in the bottom right corner where it reads “Signature.”

Step 1 – Write the Date

Fill in the date on the line in the upper right-hand corner. This step is necessary so that the bank and/or the person to whom you are presenting the cheque know when it was written.

Step 2 – Enter the Recipient’s Name Next to Pay to

The following line on the check, “Pay to” is where you enter the name of the person or firm you wish to pay. If you don’t know the actual name of the person or organization, simply put “cash.” However, keep in mind that this might be dangerous if the check is ever lost or stolen. A check made out to “cash” can be cashed or deposited by anyone.

Step 3 – Write the Amount to be Paid in Numbers

Fill in the payment amount in the little box on the right-hand side. Begin writing as far to the left as you can. To avoid fraud, place the “8” right up against the left-hand boundary of the dollar box if your payment is for $8.15.

Step 4 – Write the Amount to be Paid in Words

To avoid fraud and misinterpretation, write down the amount in words. This is the official amount of your payment. If the amount you typed in words differs from the amount you provided in numeric form in the previous step, the amount you put in words will legally be the amount of your check. Use all capital letters, which are more difficult to change.

Step 5 – Fill Memo or For Line

The check’s memo section is optional. However, filling it out is a good idea since it will remind you of why you made the check. For example, if you’re writing a check to your supplier for a product or service, you can write “their company name and service and the product you received.” If the check is for a specific bill, add your account number in the memo line.

In this part, a corporation may request that you submit your account number or invoice number. This assists them in applying the payment to your account.

Step 6 – Signature

Fill in your name on the line in the bottom right corner of your check. Make sure you sign legibly and with the same signature that your bank has on file. Your signature indicates to the bank that you agree to pay the specified amount to the payee you specified.

After Writing a Check Record the Payment in the Check Register

Make a note of the payment once you’ve written the check. A check register, whether electronic or paper, is an excellent place to do this. This will enable you to:

Keep track of your spending to avoid any bounced checks.

Understand where your money is going. Your bank statement may merely provide a check number and amount, with no indication of who you made the check to.

Fraud and identity theft might be detected in your checking account.

Tips Before Writing a Check

Before you write a check, make sure it’s something you truly need to do. Writing a check is inconvenient, and it is not the quickest way to transfer money. You may have alternative solutions that may make your life simpler while also saving you money. for example,

Pay your payments online, and even instruct your bank to send you a cheque every month. You won’t have to write a check, pay for postage, or send it in the mail.

Instead, get a debit card and use it to make purchases. You’ll pay from the same account, but this time it’ll be done online. There’s no need to use the checks (which you’ll have to re-order), and you’ll have an electronic record of your transaction that includes the payee’s name, the date of payment, and the amount.

Set up automatic payments for recurring expenses such as electric bills and insurance premiums. It’s usually free to pay this way, and it makes your life easier. Just make sure you always have enough money in your account to meet the amount.

Security Tips to Avoid Fraud in Checks

Develop the following practices to reduce the likelihood of fraud affecting your account.

Make it a permanent fixture: When writing a check, use a pen. If you write with a pencil, anybody with an eraser can modify the amount of your check and the payee’s name.

Blank checks are not permitted: Sign a check only after you’ve filled in the payee’s name and the amount. If you’re unsure who to make the check payable to or how much anything costs, carry a pen, it’s less hazardous than granting someone unrestricted access to your bank account.

Keep checks from growing: When filling out the dollar amount, make sure you print it in a way that prohibits scammers from adding to it. Begin at the far left edge of the area and draw a line following the final digit.

Checkbooks with carbon copies: Checkbooks with carbon copies are ideal if you want a paper copy of every check you write. Those checkbooks include a tiny sheet with a copy of each check you write. As a consequence, you’ll be able to immediately determine where your money went and what you wrote on each check.

Consistent signature: Many people don’t have a readable signature, and some even sign checks and credit card slips with amusing graphics. However, using the same signature on a regular basis aids you and your bank in detecting fraud. If a signature does not match, it will be easy to demonstrate that you are not liable for the charges.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.