What is Accounting?

Accounting is the various technical activities performed by accountants including financial accounting bookkeeping and Management accounting.

Accounting is considered to be as old as money however, Luca Fra Pacioli, an Italian is universally regarded as the father of the modern system of accounting or double entry system of accounting.

Accounting is the language of business because the role of accounting is to maintain and process all relevant financial information that an entity requires for its managing and reporting purposes.

Accounting is the process of documenting, categorizing, and summarizing financial transactions in order to give information for company decisions.

The field of accounting is divided into two main areas: financial accounting and management accounting. Financial accounting provides information to outsiders such as investors and creditors, while management accounting provides information to internal users such as managers.

Most businesses use Generally Accepted Accounting Principles (GAAP) to prepare their financial statements. GAAP are a set of rules and guidelines that dictate how financial statements should be prepared.

Why is Accounting Important for your Business?

1. To record the business transaction or events in a systematic manner.

2. To calculate the gross profit and net profit of a firm during a specific period.

3. To know the financial position of your firm at the close of the financial year by way of preparing the balance sheet.

4. To facilitate management control

5. To evaluate the taxable income and the sales tax liability

6. To provide requisite information to different parties i.e, owners creditors employees management government investors financial institutions banks, etc.

Function of Accounting

The various functions of accounting are as follows:

Recording:

Accounting records business transactions or events in terms of money.

Classifying:

Accounting also facilitates the classification of all business transactions.

Summarizing:

Accounting summarized classified information, done in a manner that is useful to the internal and external users.

Interpreting:

It implies analyzing and interpreting the finances that are embodied in final accounts.

Information system:

Accounting also serves as an information system it collects and communicates economic information about an enterprise to a wide range of internal and external users.

All the functions which are mentioned above can be handled by a bookkeeper, advanced accounting is typically handled by qualified accountants who possess designations such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA). They follow a set of standards known as the Generally Accepted Accounting Principles (GAAP) when preparing financial statements.

Cash Basis Accounting Vs Accrual accounting

Cash Basis Accounting:

In cash basis accounting, only actual cash receipts and payments are recorded in the books the credit transactions are not recorded at all till actual cash is received or paid.

Mercantile or Accrual Accounting

In the accrual system, all the business transactions pertaining to the specific period whether of cash or credit nature are recorded in the books this system of accounting is based on the accrual concept which states that revenue is recognized when it is earned and expense is recognized when the obligation of payment arises. The actual moment of cash is irrelevant.

Types of Accounting

There are various types of accounting. The most common types are mentioned below:

Bookkeeping:

Bookkeeping is the discipline of recording transactions in money or money’s worth in such a way that their nature and impact are understandable. Bookkeeping includes recording in general posting to the ledger and balancing accounts. The work of bookkeeping is the starting work of accounting.

Financial Accounting:

financial accounting is concerned with recording and summarising financial transactions and preparing financial statements relating to the business.

Cost Accounting:

Cost accounting is concerned with the determination of the cost of the goods and services manufactured or offered by the business.

Management Accounting:

Management accounting is the use of financial and cost data for purpose of evaluating the performance of the business as a whole and of various departments in relates to pre-determined targets.

Forensic Accounting:

Forensic accounting is the application of accounting skills and techniques to investigate and resolve financial disputes. It can be used to detect and prevent fraud, identify sources of income, and track funds. Forensic accountants may also be called upon to testify in court proceedings.

Tax Accounting:

Tax accounting is the process of preparing tax returns and ensuring that taxes are paid correctly.

Government Accounting:

Government accounting is the process of recording, classifying, and summarizing financial transactions relating to federal, state, and local governments. The purpose of government accounting is to provide accurate and timely information about a government’s financial position, performance, and cash flow.

Corporate Accounting:

When most people think of accounting, they think of tracking their personal finances. However, corporate accounting is a vital part of any business. Corporate accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions.

The main goal of corporate accounting is to ensure that a company’s financial statements are accurate and reliable. Financial statements include a company’s balance sheet, income statement, and cash flow statement. These statements show how much money a company has earned, spent, and owes over a certain period of time.

Corporate accounting is handled by accountants. Accountants are responsible for preparing financial statements, managing cash flow, and ensuring compliance with tax laws. They also advise managers on how to best manage their company’s finances.

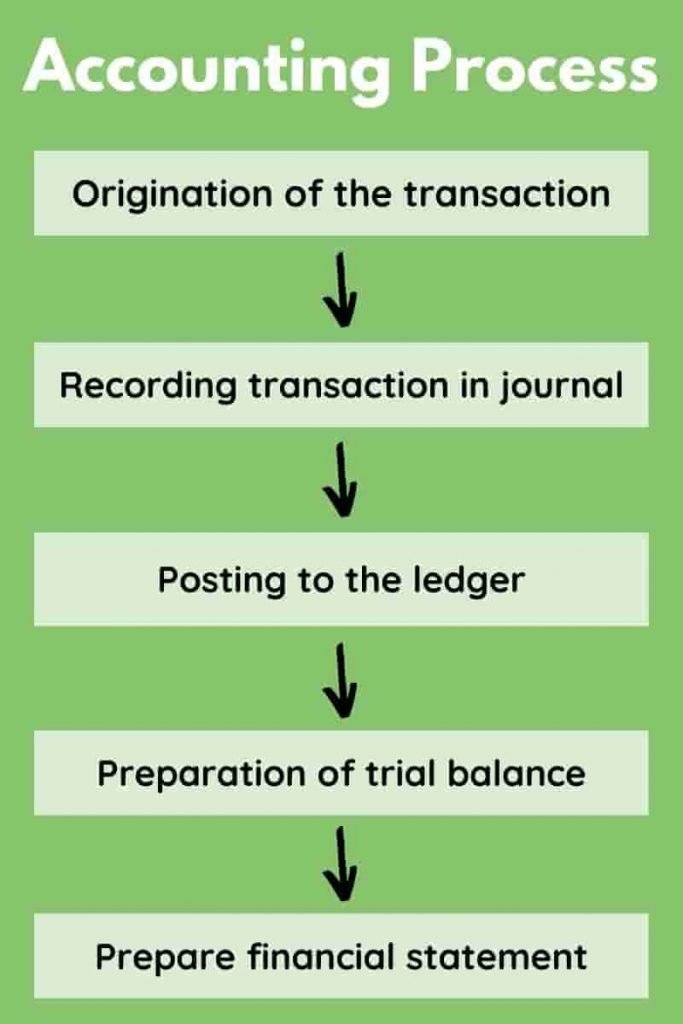

What is the Accounting cycle?

The accounting cycle is the process by which financial statements are prepared. The cycle begins with the origination of transactions and ends with the preparation of financial statements.

Steps in Accounting Cycle or Accounting Process:

1. Origination of the transaction

2. Recording the transaction in the journal.

3. Posting to the ledger.

4. Preparation of trial balance

5. Preparation of the financial statement

Important Financial Statements in Accounting

The four main financial statements in accounting are:

- The Balance Sheet

- The Income Statement or Profit or Loss Statement

- The Cash Flow Statement

- The Statement of Shareholders’ Equity

The Balance Sheet

The balance sheet is one of the key financial statements used in accounting. It shows a company’s assets, liabilities, and shareholder’s equity at a given time. The balance sheet can be used to assess a company’s financial health and to track trends over time.

The Income Statement

The income statement is one of the most important financial statements for a business. It shows how much money the company has brought in and how much it has spent. This information can be used to see if the company is making a profit or losing money. The income statement also shows which expenses are the biggest drains on the company’s finances.

The Cash Flow Statement

The cash flow statement is one of the most important financial statements for businesses. This statement shows how much cash a company has generated and used in a specific period of time. The cash flow statement is divided into three parts: operating activities, investing activities, and financing activities. This statement can help businesses predict future cash flow problems and identify opportunities to improve their finances.

The Statement of Shareholders’ Equity

The statement of shareholders’ equity is one of the most important financial statements. The statement shows the changes in a company’s equity over time. This includes the effects of issuing and repurchasing shares, dividends, and other transactions. The statement can be used to track a company’s performance and make comparisons with other companies.

How Accounting is Used in Business Decisions?

A business cannot make informed and intelligent decisions without accurate financial information. This is where accounting comes in. Accounting is the process of documenting, categorizing, and summarizing financial transactions in order to give information for company decisions.

Accounting helps businesses track their income and expenses, assess their financial health, and make smart decisions about where to invest their money. It also helps them comply with government regulations governing financial reporting.

Most businesses use accounting software to automate the accounting process. This software can help businesses track their cash flow, budget for future expenses, and forecast future sales.

Accounting is an essential part of any business and should be used to make informed decisions about where to allocate resources and how to grow the business.

What is the Difference Between Accounting and Financial Accounting?

The main difference between accounting and financial accounting is that accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions, while financial accounting is the process of preparing financial statements for external users such as investors, creditors, and regulatory agencies. Financial statements provide information on a company’s financial position, performance, and cash flow.

What Accounting is Used For?

Accounting can be used for a variety of purposes, such as measuring a company’s financial health, assessing its performance over time, and calculating its tax obligations. It is also used to make decisions about pricing, investment, and other strategic decisions.

What are the Golden Rules of Accounting?

There are a few golden rules of accounting that everyone in the field should know. These include:

1. Always record transactions in the order that they occur. This helps to ensure accuracy and makes it easier to track your financials.

2. Keep accurate records of your assets, liabilities, and equity. This information is used to generate financial statements and track your company’s financial health.

3. Make sure your books are in balance.

Conclusion

In conclusion, accounting is the recording and reporting of financial transactions. It is used to provide information that is useful in making business decisions. The accounting process begins with the identification of financial transactions and ends with the preparation of financial statements.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.