Quick Assets

Any asset that can be turned into cash quickly is referred to as a quick asset. Because they do not include inventories, these assets are a subset of the current asset categorization (which can take an excessive amount of time to convert into cash).

Cash, marketable securities, and Accounts receivable are the most likely assets. Non-trade receivables, such as employee loans, are not considered quick assets since they may be difficult to convert into cash in a reasonable amount of time.

Quick Assets List

Following are the quick assets that can be seen under the balance sheet of a company:

- Cash.

- Marketable securities.

- Accounts receivable.

- Prepaid expenses.

- Short-term investments.

Cash

Cash is the most liquid asset a firm may have in terms of accounting. A cash balance suggests that a corporation has cash on hand that it may utilize however it sees fit.

Cash consists of more than simply tangible notes and coins. Cash can contain any other currency, as well as undeposited checks and current account balances.

Marketable securities

Marketable securities are liquid assets that are easily convertible into cash and are listed under the heading current assets in the company’s balance sheet, with the main examples being commercial paper, Treasury bills, commercial paper, and other money market instruments.

Account Receivable

Accounts receivable (AR) is the amount owing to a business for goods or services delivered or used but not yet paid for by customers.

On the balance sheet, accounts receivable are categorized as a current asset. Any amount of money owed by customers for credit purchases is referred to as AR.

Prepaid Expenses

Prepaid expenses are future expenses that are paid in advance; hence, the expense remains a current asset until the related benefits are achieved.

Until complete consumption, the prepaid expense is recorded in the balance sheet’s current assets section (i.e. the realization of benefits by the customer).

Short-term Investments

Short-term investments, also known as marketable securities, are financial instruments (debt or equity investments) that may be readily changed into cash within three to twelve months and are classed as Current Assets on the Balance Sheet.

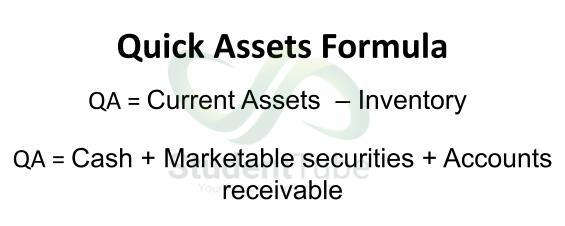

Quick Assets Formula

The quick assets formula is very simple we can calculate quick assets by subtracting Inventory from current assets.

Quick Assets Formula = Current Assets – Inventory

How to Calculate Quick Assets

Let’s take an example to understand the calculation of quick assets:

Company ABC has $5,000 in cash, $10,000 in marketable securities, and $15,000 in accounts receivable that will be paid in two months. What are the Company’s quick assets?

Quick assets = cash + marketable securities + accounts receivable

= 5000 + 10,000 + 15,000

= $ 30,000

Let’s take another example:

Company XYZ has $ 50000 in current assets and $ 30000 in inventory. What is the value of the Company’s quick assets on its balance sheet?

Quick asset = Current Assets – Inventories.

= $50,000 – $30,001

= $20,000

How to Calculate Quick Ratio

The quick ratio is a financial indication of short-term liquidity, or the capacity to raise funds to pay debts that are due within the next 90 days. The quick ratio assesses a company’s capacity to pay its short-term creditors. The quick ratio is calculated by dividing quick assets by current liabilities.

There are two methods for calculating quick ratio:

Quick Ratio = (Current Assets – Inventories) / Current Liabilities

Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

Quick Asset Vs Current Assets

- Inventory is not considered quick assets since they cannot be readily converted to cash. Inventory and prepaid expenses, as well as other liquid assets, are examples of current assets.

- In the statement of financial position, quick assets are not listed as a distinct heading. In the statement of financial position, current assets are reported as a distinct heading.

- Liquid assets, also known as quick assets, aid in establishing the company’s quick ratio. Current assets aid in assessing the company’s current ratio.

- In practice, liquid or quick assets are regarded as the most liquid assets since they can be changed into cash more rapidly than current assets. Current assets are regarded as less liquid than quick assets in practice since it takes time to convert a few components of current assets into cash.

What Is the Importance of Quick Assets?

Quick assets are an important component of the quick ratio, which is used to determine whether and how effectively a firm can pay its short-term financial responsibilities. The acid-test ratio is another name for the quick ratio.

A quick ratio of one to one (1:1) or more indicates that a corporation can pay its current creditors.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.