T Accounts Chart

A T-Account resembles a capital T. Each account will be assigned its own T. Increases and decreases will be recorded on the appropriate debit or credit side, depending on the kind of account used.

- A debit simply refers to the left side.

- A credit simply refers to the right side.

- To summarize a T-Account, add both sides and place the account balance (the difference between the two sides) on the side with the higher total. This is known as “footing” an account.

Example Of T Accounts

Following Are The Examples Of T Accounts Chart

How To Use T Accounts

A T-account gives an accurate and comprehensive view of an organization’s incoming and departing cash flow. The procedures below demonstrate how to record debits and credits in a T-account:

1. Arrange all financial information.

To organize transactions in the T-account, use the general ledger, income statement, or balance sheet. Each sort of account necessitates its own T-chart, therefore it’s critical to differentiate the transactions you wish to record. A bookkeeper, for example, maintains debits and credits separately from liabilities in revenue accounts.

2. Make a T-chart

Use a T-chart template with a horizontal line at the top and a vertical line separating the left and right sides of the sheet. Create a T-chart template for each account you wish to balance if you intend to track multiple account transactions.

Establish one T-account for each asset, expense, or other accounts you wish to track, then categorize the debit and credit entries for each T-account you create.

Debits to assets are shown as rises, while credits are shown as decreases, and debits lower expense accounts while credits raise expense accounts.

3. Make a list of your debits and credits.

Once you’ve organized the debit and credit transactions for each account, list the debits on the left and the credits on the right side of the chart. To represent all incoming and outgoing cash flow, each transaction must balance in the T-account for both credits and debits.

Furthermore, outgoing cash flow might indicate future payments made by businesses for costs and obligations, whilst incoming cash flow can represent payments made by businesses in the future.

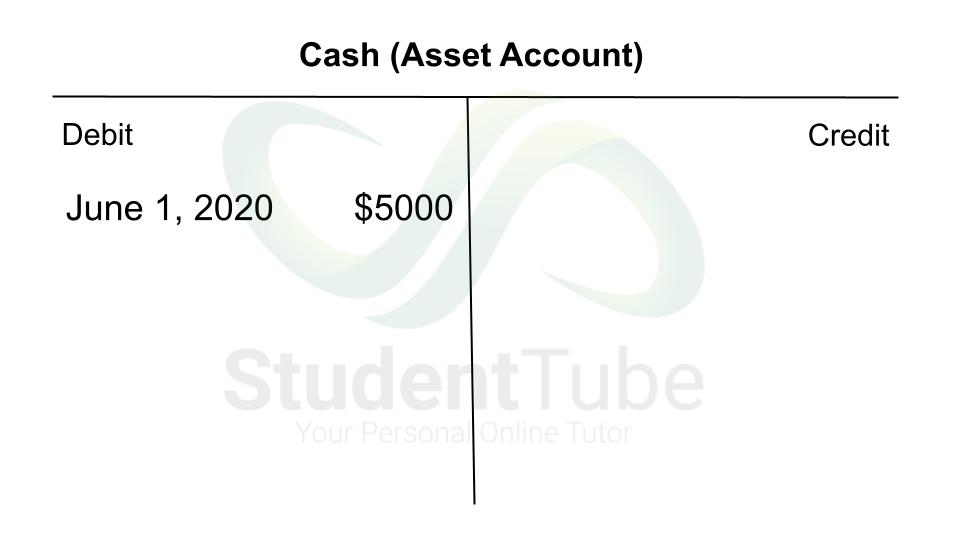

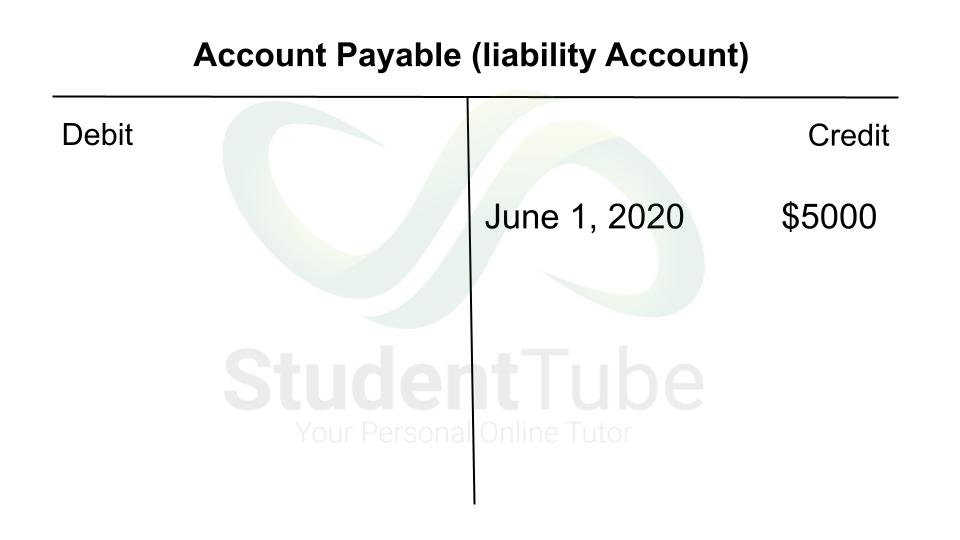

T Account For Cash and Account Payable

Let’s put Cash and Account Payable T-accounts to use with two transactions:

A corporation borrows $5,000 from its bank on June 1, 2020. As a result, the company’s asset Cash must be increased by $5,000, as must its liability Account Payable.

The account must be debited in order to increase the asset Cash. This account must be credited in order to enhance the company’s liabilities.

The T-accounts look like this when you enter the debits and credits:

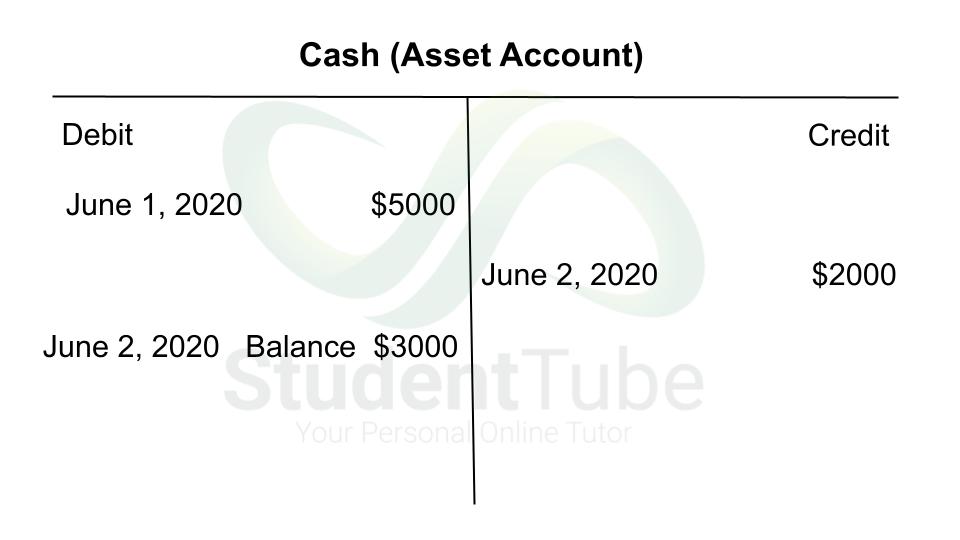

The corporation repays the bank loan of $2,000 on June 2, 2020. As a result, the company’s asset Cash must be reduced by $2,000, and its liability Account Payable must be reduced by the same amount.

To lower the asset Cash, the account must be credited with $2,000. To reduce the liability Account Payable, that account must be debited for $2,000.

The T-accounts are now as follows:

T Account For Account Receivable

To calculate the balance of Accounts Receivable, use the following transaction and t-account.

- At the start of the year, ABC Company had $120,000 in accounts receivable.

- During the year, it made a total of $200,000 in account sales.

- Customers’ accounts totaled $220,000, which the corporation was able to recover.

- ABC wiped down $10,000 after determining that the receivables were uncollectible.

All Accounts Receivable increases are recorded on the debit side (since it is an asset account). All decreases are applied to the credit side. Total debits are $320,000, while total credits are $230,000. Subtract them and as a result, accounts receivable has a $90,000 debit balance.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.