What is an Income Statement

The income statement is one of three main financial statements used to disclose a company’s financial performance over a specific accounting period, along with the balance sheet and the statement of cash flows.

The income statement, also known as the profit and loss statement or the statement of revenue and expense, focuses on the company’s profits and expenditures over a specified period.

Parts of an Income Statement:

An income statement includes the following detail. This document’s format can differ based on regulatory criteria, diverse market needs, and related organizational activities.

Revenue /Sales:

This is the first portion of the financial statement, and it summarizes the company’s gross profits. Revenue is split into two categories: operating and non-operating. The income received by a corporation from primary operations such as selling a product or delivering a service is referred to as operating revenue.

Non-operating revenue is generated by non-core market operations such as system installation, service, or repair.

Cost of Goods Sold (COGS):

This is the overall cost of sales or services, also known as the cost of producing goods or services. Remember that it just covers the expense of the goods you deliver. A COG does not necessarily contain additional costs such as overhead.

Gross Profit:

Net profits minus the total cost of products sold in your business equals gross profit. Net sales are the funds you received for the products sold, while COGS are the funds you invested to manufacture those goods.

Gains:

Gain is the outcome of a positive event that increases an organization’s profits. Gains represent the amount of money earned by the firm as a result of different corporate practices such as the selling of an operating segment. Similarly, earnings from one-time non-financial operations are included as business gains.

Expenses:

Expenses are the costs incurred by the corporation in order to raise sales. Equipment depreciation, employee salaries, and retailer fees are all examples of typical expenditures. There are two types of company costs: operating expenses and non-operating expenses.

Expenses incurred as a result of a company’s main business operations are known as operating expenses, and those incurred as a result of non-core business activities are known as non-operating expenses. Operating expenses include sales commissions, tax payments, and payroll, while non-operating expenses include expired inventory costs and litigation settlements.

Advertising Expense:

These are essentially the promotion costs necessary to broaden the customer base. These contain print and online advertisements, as well as radio and video advertisements. Advertising costs are typically included in Sales, General, and Administrative (SG&A) expenses.

It is classified as expenses made by a corporation or organization as a whole, as opposed to expenditure incurred by individual divisions within the same company. Salaries, leases, office materials, and travel costs are examples of operating expenses. Administrative expenses are fixed in nature and appear to occur regardless of revenue volume.

Depreciation Expense:

The method of spreading the cost of a long-term asset over its life cycle is referred to as Depreciation. It is a management arrangement to write down the asset valuation of a company, but it is a non-cash transaction. Depreciation primarily reflects the asset valuation reduced by the company over time.

Earnings Before Tax (EBT):

This is a method for assessing a company’s financial results. EBT is measured by deducting costs from pre-tax revenue. It’s a line item on a multi-step income statement.

Net Income:

Net profit is the amount of money received by deducting authorized company expenses. Total expenditures are subtracted from total sales to arrive at this figure. Although a net profit is a company’s earnings, gross profit is the money received by deducting the expense of products sold.

What is the Purpose of the Income Statement?

The main purpose of an income statement is to communicate to creditors the facts of the company’s profitability and financial activities; it also offers comprehensive information into the company’s internals for analysis across various industries and sectors.

Types of the Income Statement:

There are two types of income statements:

- Single-step income statement

- Multi-step income statement

Single-step Income Statement:

There are no sub-totals such as gross benefit, net profits, earnings before taxation, and so on in a single-step income statement.

To create a single-step income statement, separate revenue items from expenditures, then deduct total expenses from total sales to calculate net income — it’s that easy. This is why the approach is referred to as “single-step” and is simple to execute.

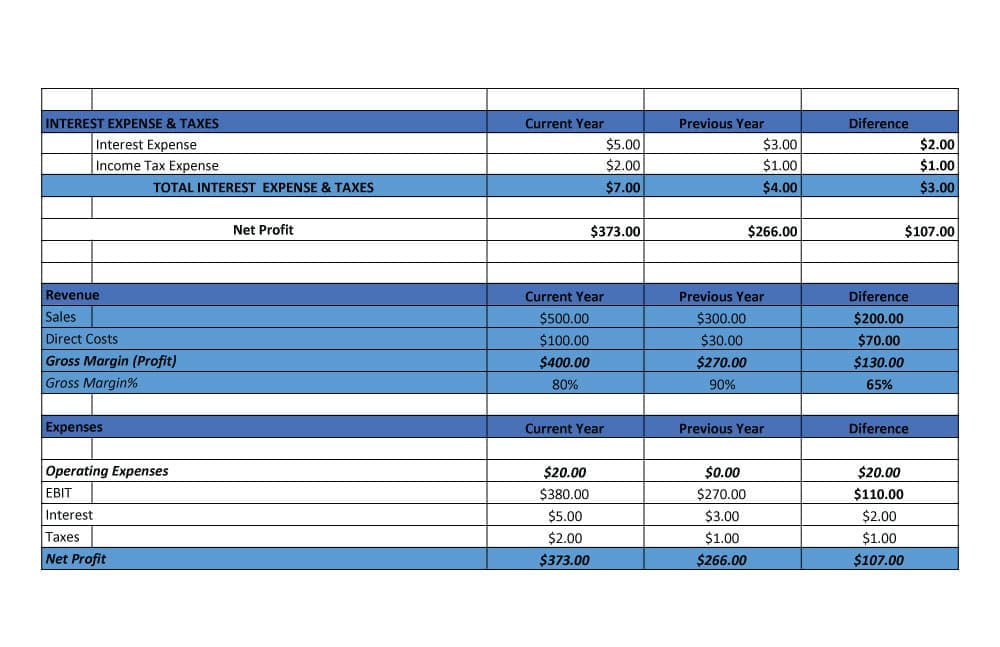

Single-step Income Statement Example:

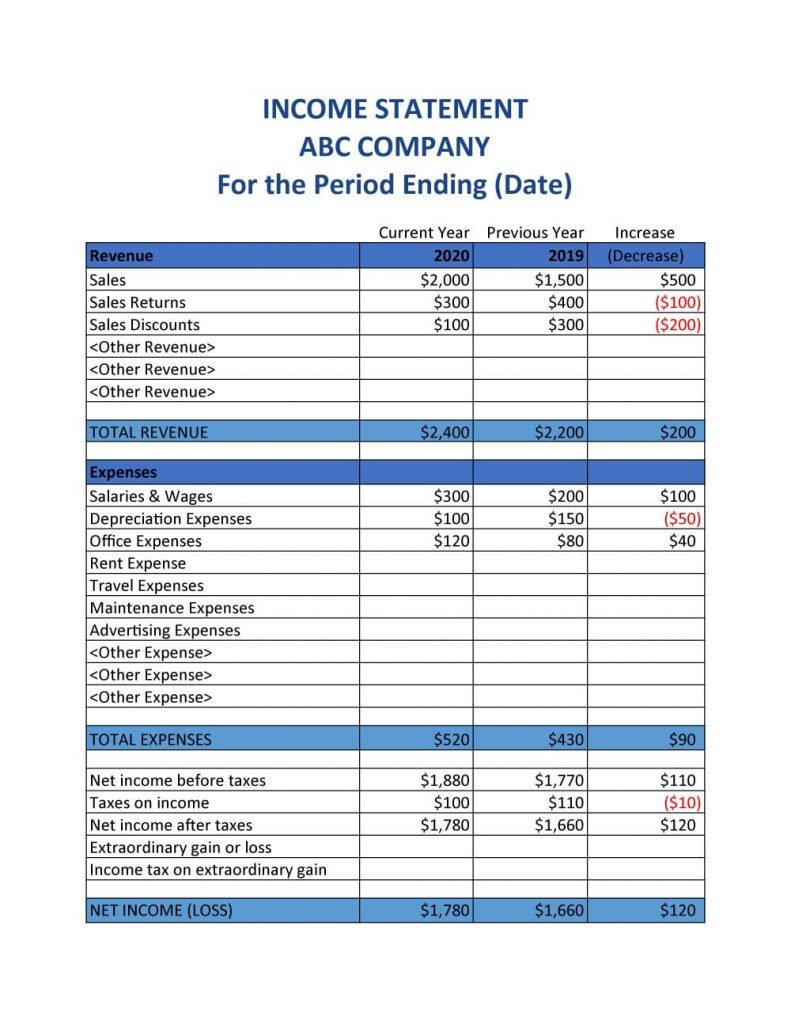

Multi-step Income Statement:

In a multi-step income statement, related costs are put together, and intermediate estimates such as gross benefit, net income, EBIT, and so on are calculated.

A multiple-step statement of profit and loss emphasizes intermediary indicators such as gross profit and operating profits. Begin with sales revenue and deduct merchandise costs to arrive at gross profit. Subtract operational costs from the final component to measure operating revenue, also known as “income from continued operations.”

Calculate pre-tax profits by adding and subtracting non-operating products, such as the net impact of accounting adjustments and the disposal of company units, as well as extraordinary gains and losses, from this figure. Net income is calculated by subtracting pretax income from fiscal dues.

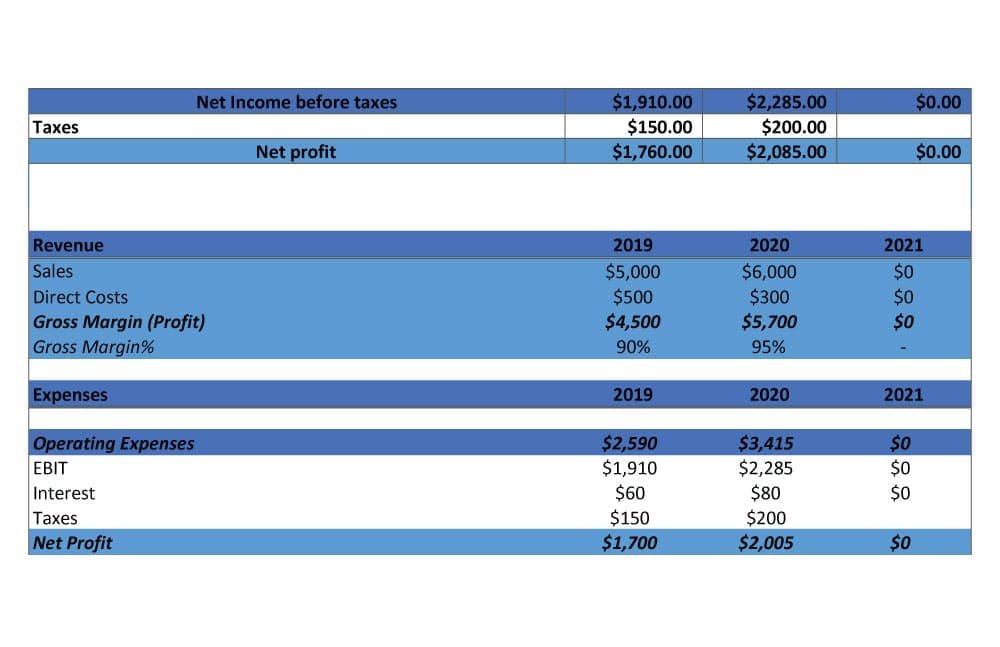

Multi-step Income Statement Example:

What is Pro forma Income Statement?

A pro forma income statement is one that is focused on expectations or possible outcomes. Companies also use pro forma income statements to predict what could happen in advance of a case. For example, if the corporation is considering a merger, a pro forma income statement might be planned to ascertain the merger’s profitability.

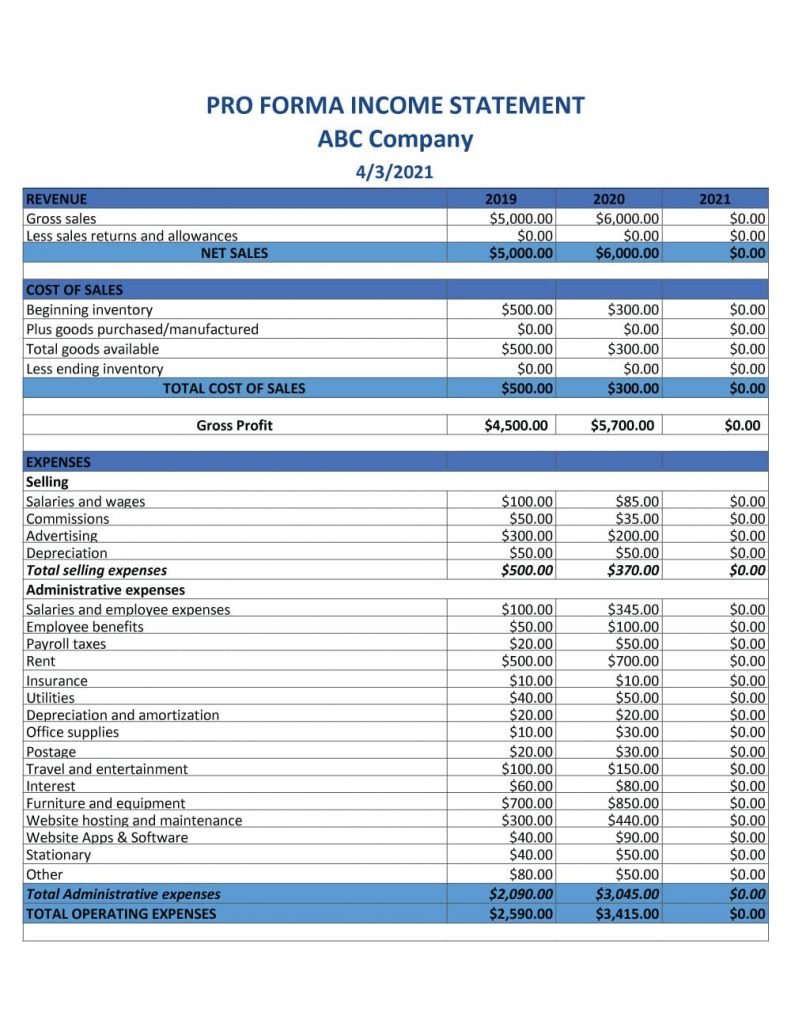

Pro forma Income Statement Example:

Difference Between Balance Sheet and Income Statement:

While the balance sheet and the profit and loss statement includes some of the same financial information (such as sales, expenses, and profits), there are significant differences between them.

Each statement is designed for a specific reason. Balance sheets are constructed in a broader sense, showing what the business owns and owes as well as its long-term savings. Unlike an income statement, the balance sheet shows the entire value of long-term investments or debts.

The profit and loss statement asks a single question: Is the business profitable? Although accountants use the P&L statement to determine the quality of financial transactions, investors use the P&L statement to assess a company’s performance.

A balance sheet reports a company’s assets, liabilities, and equity at a given point in time, while a profit and loss statement summarizes a company’s sales, costs, and expenses over a specific time period.

The profit and loss statement reveals net profits, which indicates whether a business is in black or red. The balance sheet reveals how much a corporation is really worth, i.e. its overall value.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also. For What are Liabilities in Accounting? Click Here or for What is Income? Click here