What Is Amortization?

Amortization is the process of repaying debt in equal amounts over time. Part of each payment is applied to the loan principle and part to the interest. As the debt amortizes, the amount paid toward principal begins modest and steadily increases month by month. An amortization schedule shows the amount of money you pay in principle and interest over time.

Amortization is an accounting practice that is used to reduce the book value of a loan or an intangible asset on a regular basis over a predetermined period of time. When it comes to loans, amortization is the process of spreading out loan payments over time. Amortization is similar to depreciation when applied to an asset.

Amortization of Assets

When it comes to assets, notably intangible assets that are not physical, such as branding, intellectual property, and trademarks, amortization means something else. In this context, amortization is the periodic decline in value over time, similar to fixed asset depreciation.

The amortization of an asset, such as a building, a machine, or a mine, over its anticipated life reduces its balance-sheet valuation and charges its cost to operating expenditures. Such expenditure is known as depreciation or, in the case of finite natural resources, depletion.

Some assets, such as abandoned or lost property in a disaster, may be carried among the firm’s assets until their extinction is achieved by gradual amortization.

Depreciation is calculated by dividing the item’s initial cost by its useful life, or the period of time the asset may be considered usable before it has to be replaced.

As an example, if a new firm spends $30,000 on machinery to utilize in their manufacturing operation, it will not be worth the same amount 5 or 10 years later. Nonetheless, the asset must be recorded on the company’s balance sheet.

So, if the machinery’s useful life is ten years, its worth would depreciate by $3,000 every year.

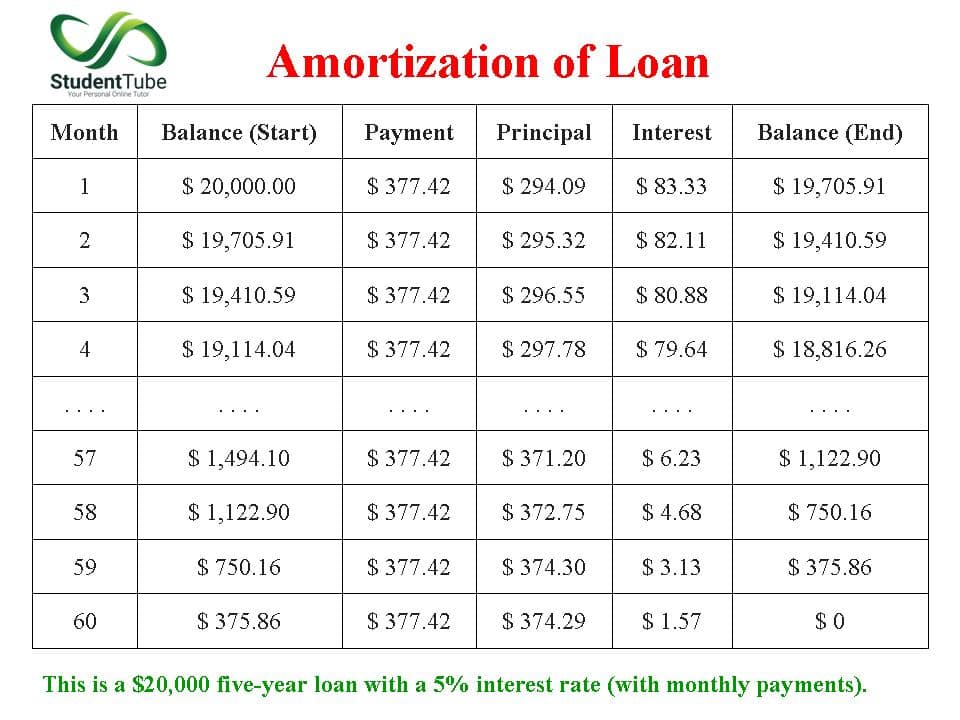

Amortization of Loan

An amortized loan is the process of repaying the outstanding debt in full over time. When a loan is issued, a sequence of fixed instalments is usually established from the start, and the individual receiving the loan is responsible for paying each of the payments.

The loan’s principal and interest payments will vary from month to month, but the payment amount will be constant during each payment period.

How Does Amortization Work?

An amortization chart is the easiest method to comprehend amortization. The table was provided with your loan documentation if you have a mortgage.

An amortization table is a plan that shows how much of each monthly loan payment goes to interest and how much goes to principle. Every amortization table contains the same type of data:

Scheduled Payments: For the duration of the loan, your needed monthly payments are given separately by month.

Principle Repayment: After you apply the interest charges, the remaining of your payment goes toward repaying your debt.

Interest Expense: Interest costs are deducted from each scheduled payment and are determined by multiplying your remaining loan balance by your monthly interest rate.

While your overall payment remains constant, you will pay off the loan’s interest and principle in various amounts each month. The interest rate is the highest at the beginning of the loan.

As time goes on, a larger part of each payment is allocated to your principal, and you pay a less amount of interest each month.

Amortization Vs Depreciation

Amortization and depreciation are concepts that are similar in that they both aim to represent the cost of retaining an item over time. The primary distinction is that amortization applies to intangible assets whereas depreciation refers to tangible assets.

Trademarks and patents are examples of intangible assets, while tangible assets include equipment, buildings, cars, and other assets that are susceptible to physical wear and tear.

We also have:

What is Depreciation in Accounting?

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures in Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.