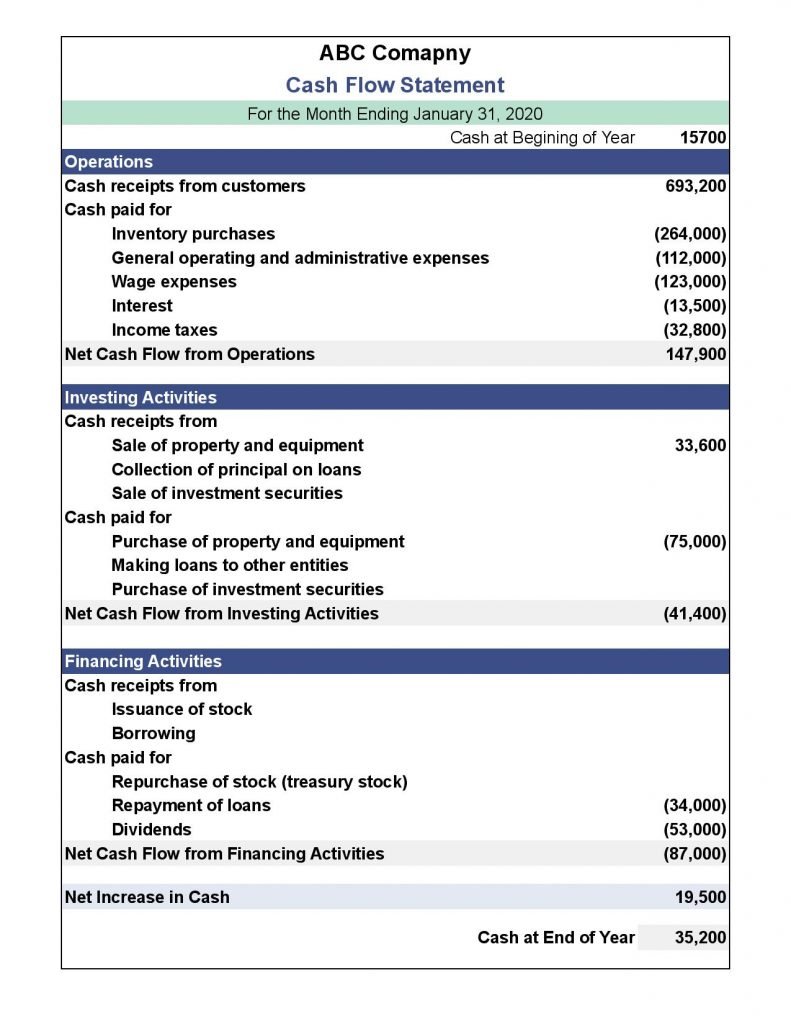

The Cash Flow Statement

The cash flow statement or the statement of cash flows is a financial statement that summarizes the amount of cash and cash equivalents entering and exiting a business.

A cash flow statement is a financial statement that summarizes all cash inflows received from an organization from operating activities and external investment sources. It also covers all cash outflows used to fund corporate operations and investments over a given period of time.

The cash flow statement (CFS) assesses how well an organization handles its cash balance, or how well it raises cash to pay financial obligations and cover operating expenses. Since 1987, the cash flow statement has been required as a complement to the balance sheet and income statement of a company’s financial reporting.

Three Sections of the Statement of Cash Flows:

The cash flow statement is considered to be the most descriptive of all financial statements because it tracks cash earned by the corporation in three ways: operations, investment, and financing. Net cash flow is the sum of all three segments.

These three sections of the cash flow statement will assist investors in determining the value of a company’s stock or the company as a whole.

Operating Activities:

An organization’s primary revenue-generating activities as well as any non-investment or funding practices; any cash flows between current assets and current liabilities.

Investing Activities:

All capital balances resulting from the buying and selling of long-term properties and other transactions that are not found in cash equivalents.

Financing Activities:

All cash flows that result in changes in the size and structure of the entity’s contributed equity capital or borrowings (i.e., bonds, stock, dividends)

Cash Flow Statements Prepared By Using the Direct and Indirect Methods

You have two options for calculating the company’s cash flow: the direct method or the indirect method. Although all are approved by generally accepted accounting principles (GAAP), small companies usually use the indirect method.

Cash Flow Statement By Direct Method

Using the direct method, you keep a list of cash as it enters and exits the company and then use the report to prepare a cash flow statement at the end of the month.

The direct method necessitates more effort and coordination than the indirect method since you must create and register cash receipts for each cash transaction. As a result, smaller companies usually choose the indirect method.

It’s also worth noting that even though you report cash flows in real-time using the direct method, you’ll need to use the indirect method to compare the cash flow statement with your income statement. As a result, the direct method would normally take longer than the indirect method.

Cash Flow Statement By Indirect Method

The indirect method involves looking at the transactions on your income statement and then reversing some of them to determine your working capital. You’re selectively backtracking the income statement to exclude transactions that don’t show cash movement.

Many small companies choose this method because it is easier than the direct method. You still don’t have to go back and reconcile the statements with the direct method by using the indirect method.

Cash Flow Statement Example / Sample:

Cash Flow Statement Purpose

A cash flow statement is an important indicator of a company’s strength, sustainability, and long-term future prospects. The CFS will assist in determining whether a corporation has sufficient capital or cash to cover its expenses. A cash flow statement may be used by an organization to forecast potential cash flow, which helps in budgeting.

An investor can obtain a good view of how much cash a business earns and a solid understanding of its financial well-being by reviewing the cash flow statement.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.