What is Ledger in Accounting

An accounting ledger is a type of account or document that is used to keep track of bookkeeping entries for balance-sheet and income-statement transactions. Cash, accounts receivable, investments, inventory, accounts payable, accrued expenses, and customer deposits are included in financial ledger journal entries.

Accounting ledgers are used to record both balance sheet and income statement transactions. Asset ledgers, such as cash or accounts receivable, are included in balance sheet ledgers. Revenue and expense ledgers are included in income statement ledgers.

Types of Ledger

Following are the type of ledger:

Sales Ledger:

The Sales Ledger is a ledger in which the company records the sale of merchandise, commodities, or the expense of goods delivered to consumers. This ledger represents the sales earnings and income statement.

Purchase Ledger:

The Purchase Ledger is a ledger in which the organization organizes the purchase of commodities, items, or goods from other companies. It shows how much money the organization paid to other companies.

General Ledger:

There are two kinds of General Ledger:

- Nominal Ledger

- Private Ledger

The nominal ledger records wages, revenue, depreciation, insurance, and so on. And a private ledger provides private records such as salaries, benefits, capital, and so on.

The Advantages of Using a Ledger

The ledger is a fundamental piece of accounting and forms the backbone of the financial statements. The ledger is a chronological record of transactions. It ensures the accuracy and completeness of the financial records. The ledger facilitates the analysis of the financial data. It also provides a record that can be used for tax purposes and other regulatory requirements.

Difference Between Journal and Ledger:

Both the journal and the ledger are major elements of the accounting process. Company transactions are primarily reported in the journal and then posted to the ledger under the appropriate heads. Many financial transactions are recorded in both the journal and the ledger.

Financial transactions are recorded in a journal using the double-entry method. That is sometimes referred to as the primary accounting book or the book of original entry.

The ledger, on the other hand, is referred to as the Principle book of accounting. It keeps the journal information in the “T” format. It is used to generate the trial balance, which serves as the foundation for financial reporting such as the income statement and balance sheet.

Journalizing refers to the method of recording transactions in a journal, while posting refers to the process of moving entries from the journal to the ledger.

A journal’s transactions are recorded in chronological order, making it easier to distinguish the transactions that are correlated with a particular business day, week, or billing cycle. The organization of entries within a ledger, on the other hand, is more concerned with grouping like transactions together into separate accounts for the purposes of analyzing the records for internal financial and accounting purposes.

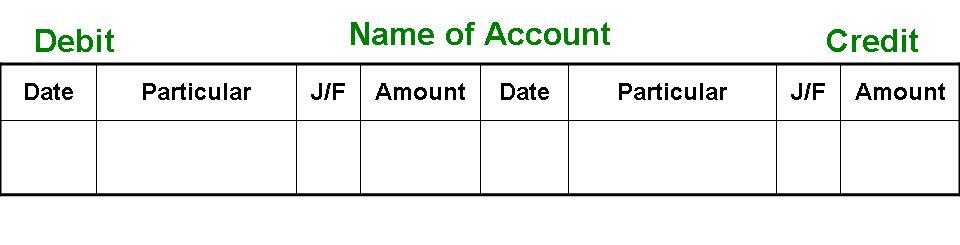

Format of Ledger Account:

The ledger account is formatted in T. It’s split into two parts. The left side is the debit side, and the right side is the credit side. There are four columns on each side. The account’s name or title is placed in the top middle, and the details are entered into the ledger. The format of the ledger account is mentioned below:

The below are the details contained in the ledger’s different columns:

Date: The transaction’s date is reported in this column.

Particulars: This column records the transaction that has been debited or paid. On the debit line, entries begin with ‘To,’ and on the credit side, entries begin with ‘By.’

Journal Folio (J.F.): The page number of the journal or subsidiary books from which the entry was posted to the ledger is noted in this column.

Amount: The transaction’s amount is reported in this column.

What is Ledger Balance?

A bank computes a ledger balance at the close of each business day, which contains both withdrawals and deposits to determine the total amount of money in a bank account. The ledger balance is the starting balance of the bank account the next morning and remains constant throughout the day.

The ledger balance, which varies from the available balance in an account, is also known as the current balance. When you log into your online banking, you will be able to see the current balance—the balance at the start of the day—as well as your remaining balance, which is the cumulative sum at some time during the day.

The ledger balance is used in banking and accounting for reconciliation.

What is meant by ledger in accounting?

A ledger is a record of financial transactions. It includes information about the amount of money involved in each transaction, the date of the transaction, and the parties involved.

What is a ledger account?

A ledger account is a record of financial transactions. The transactions are listed in chronological order, and each account is updated to reflect the new balance. Ledger accounts are used to track assets, liabilities, equity, revenue, and expenses.

What is the format of ledger?

Ledger is a record of financial transactions. The format of a ledger is typically a columnar format, with each transaction recorded as a row. The date, amount, and description of the transaction are typically included.

What are the two types of the ledger?

There are two types of ledger: the general ledger and the subsidiary ledger. The general ledger is a compilation of all the subsidiary ledgers, and it shows the balances of all accounts in the organization. The subsidiary ledger is a detailed record of transactions for a specific account.

What is GL process?

GL stands for General Ledger. The GL process is the process of recording and tracking financial transactions in a company’s accounting system. This includes recording revenue, expenses, assets, and liabilities. The GL process ensures that the company’s financial statements are accurate and up-to-date.

What is a ledger and examples?

A ledger is a record of financial transactions. It can be an electronic record or a physical book. The transactions are recorded in chronological order and include the date, the amount, and the parties involved. Some common examples of financial transactions that would be recorded in a ledger include purchases, sales, payments, and receipts.

What is the ledger and trial balance?

Ledger is a list of all the transactions that have taken place in a company over a particular period of time. A trial balance is a list of all the debit and credit balances in a company’s ledger. It is used to check that the total of the debit balances is equal to the total of the credit balances.

For more click here and if you are looking for full forms of different acronyms and words then check out this list you really gonna find this helpful. We also have an Essay on every topic, Check the complete list here. If you are Studying in Matric Free Video Lectures of Maths, Physics and English are here, and we have got you covered for I.COM Business Maths also.